Woodstock City Council has approved a tax rate increase of 2.55 percent. This means taxes will increase by $81 dollars this year based on the average house assessment.

WOODSTOCK - The City of Woodstock has approved the 2022 Revenue Fund budget.

The budget will support around $89 million in expenditures for programs and services. The City already approved the 2022 Capital Budget in December, which called for $25.7 million in capital projects for 2022.

The Revenue Fund Budget includes a tax levy for City purposes of $64 million, which results in a tax rate increase of 2.55 percent.

Some of the highlights from the budget include:

- A return of recreation and culture programming, summer camps and special events.

- Additional full-time and part-time staff to manage the workload of a growing City.

- The conversion of the Market Centre west end for the purposes of a City Hall annex.

- Additional bylaw enforcement and security services for Downtown Woodstock.

- Funding for physician recruitment to enhance our programs that attract new doctors to our community.

- Investments in technology to improve efficiencies.

- The first increase in transit fares since 2016 with a 25 cent increase to be effective midyear.

Acting Mayor Connie Lauder says the budget will result in an increase of $81.19 or 2.55 percent for the average house assessment, compared with 2021.

"This is a budget that marks a return of the many programs, services, and events that we have been unable to offer over the past two years due to the pandemic. This is also a budget that responds to the significant growth of the City."

Oxford OPP Investigating a Robbery

Oxford OPP Investigating a Robbery

WITAAR's Latest Report is Here

WITAAR's Latest Report is Here

A Woodstock Woman is Missing

A Woodstock Woman is Missing

CAMI is Entering Temporary Shutdown

CAMI is Entering Temporary Shutdown

Local Mother Shines a Light on Bullying

Local Mother Shines a Light on Bullying

Interview with the Warden - Apr. 10th, 2025

Interview with the Warden - Apr. 10th, 2025

Measles Cases Rising Province Wide

Measles Cases Rising Province Wide

Woodstock Bar Receives Liquor Licence Suspension

Woodstock Bar Receives Liquor Licence Suspension

UPDATE: Unifor 636 Cancels Federal Debate

UPDATE: Unifor 636 Cancels Federal Debate

Ongoing Investigation After a Theft at Rexall

Ongoing Investigation After a Theft at Rexall

Break-and-Enter in Paris

Break-and-Enter in Paris

Easter Egg Hunt Returns to Harold Bishop Park

Easter Egg Hunt Returns to Harold Bishop Park

Race Against Darkness Supporting Mental Health

Race Against Darkness Supporting Mental Health

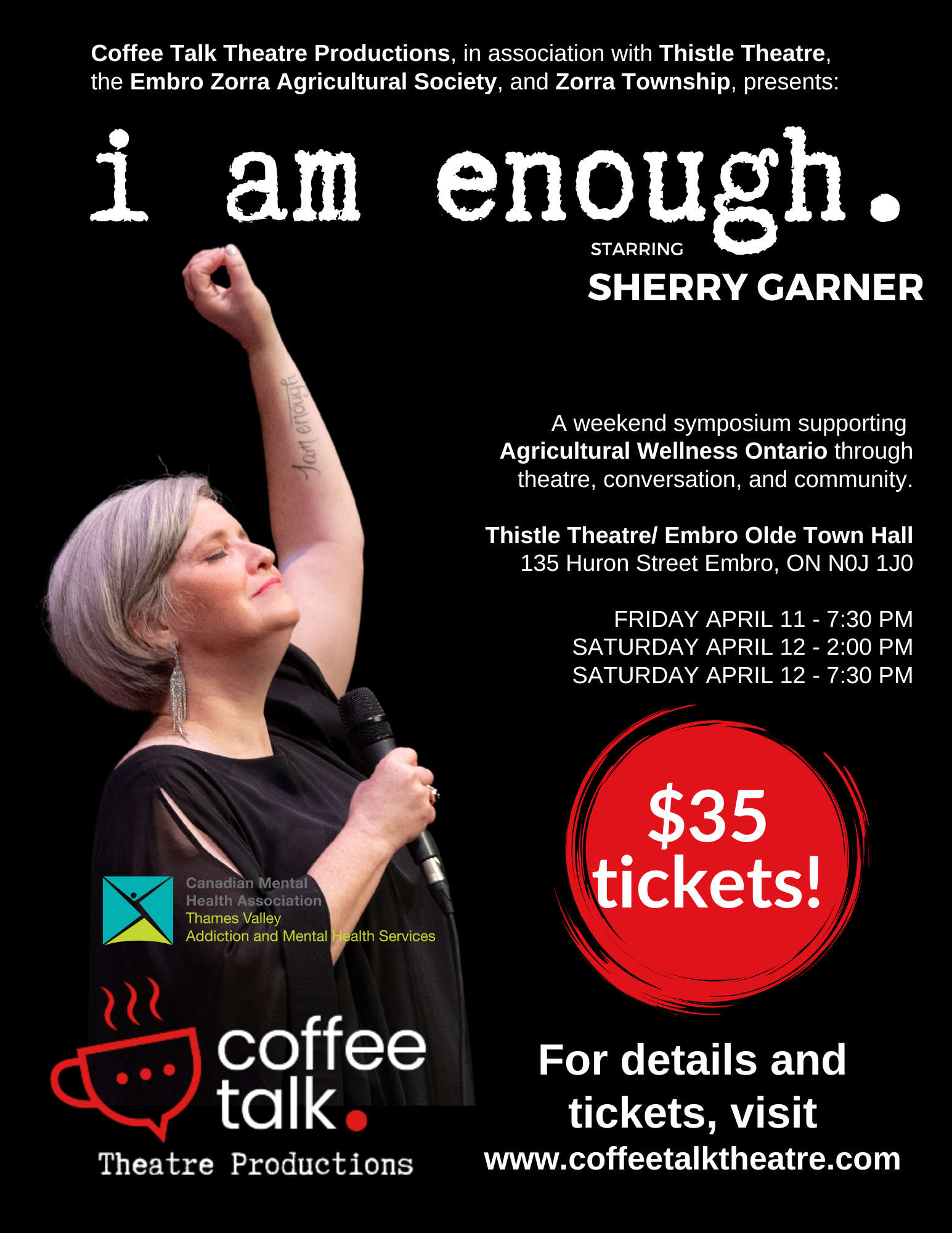

I Am Enough Comes this Weekend

I Am Enough Comes this Weekend

The OCFA has Announced their Hall of Fame Recipient

The OCFA has Announced their Hall of Fame Recipient

Strong Mayor Powers are Expanding

Strong Mayor Powers are Expanding

Markham Man Charged in South-West Oxford

Markham Man Charged in South-West Oxford

CHP Candidate Profile: Jacob Watson

CHP Candidate Profile: Jacob Watson

Trevor Birtch Trial Daily Recap - Case 1

Trevor Birtch Trial Daily Recap - Case 1

Comments

Add a comment