Woodstock City Council will be asked approve final tax rates at their upcoming meeting on Thursday night.

WOODSTOCK - Woodstock City Council will be asked approve final tax rates at their upcoming meeting.

If approved, Patrice Hilderley the Director of Administrative Services says the average homeowner might notice a rise in their taxes.

"The average house is valued at $227,500 and the increase on that house will be $86.44 in 2016."

The tax rate has gone up approximately 1.03 percent. Hilderley adds the city has entered a new reassessment cycle, so the impact will really depend on the resident's current property value.

This means some people may have a tax increase while others experience a tax decrease. If council decides not to approve the rates, they will have to make changes to the budget.

Oxford OPP Investigating a Robbery

Oxford OPP Investigating a Robbery

WITAAR's Latest Report is Here

WITAAR's Latest Report is Here

A Woodstock Woman is Missing

A Woodstock Woman is Missing

CAMI is Entering Temporary Shutdown

CAMI is Entering Temporary Shutdown

Local Mother Shines a Light on Bullying

Local Mother Shines a Light on Bullying

Interview with the Warden - Apr. 10th, 2025

Interview with the Warden - Apr. 10th, 2025

Measles Cases Rising Province Wide

Measles Cases Rising Province Wide

Woodstock Bar Receives Liquor Licence Suspension

Woodstock Bar Receives Liquor Licence Suspension

UPDATE: Unifor 636 Cancels Federal Debate

UPDATE: Unifor 636 Cancels Federal Debate

Ongoing Investigation After a Theft at Rexall

Ongoing Investigation After a Theft at Rexall

Break-and-Enter in Paris

Break-and-Enter in Paris

Easter Egg Hunt Returns to Harold Bishop Park

Easter Egg Hunt Returns to Harold Bishop Park

Race Against Darkness Supporting Mental Health

Race Against Darkness Supporting Mental Health

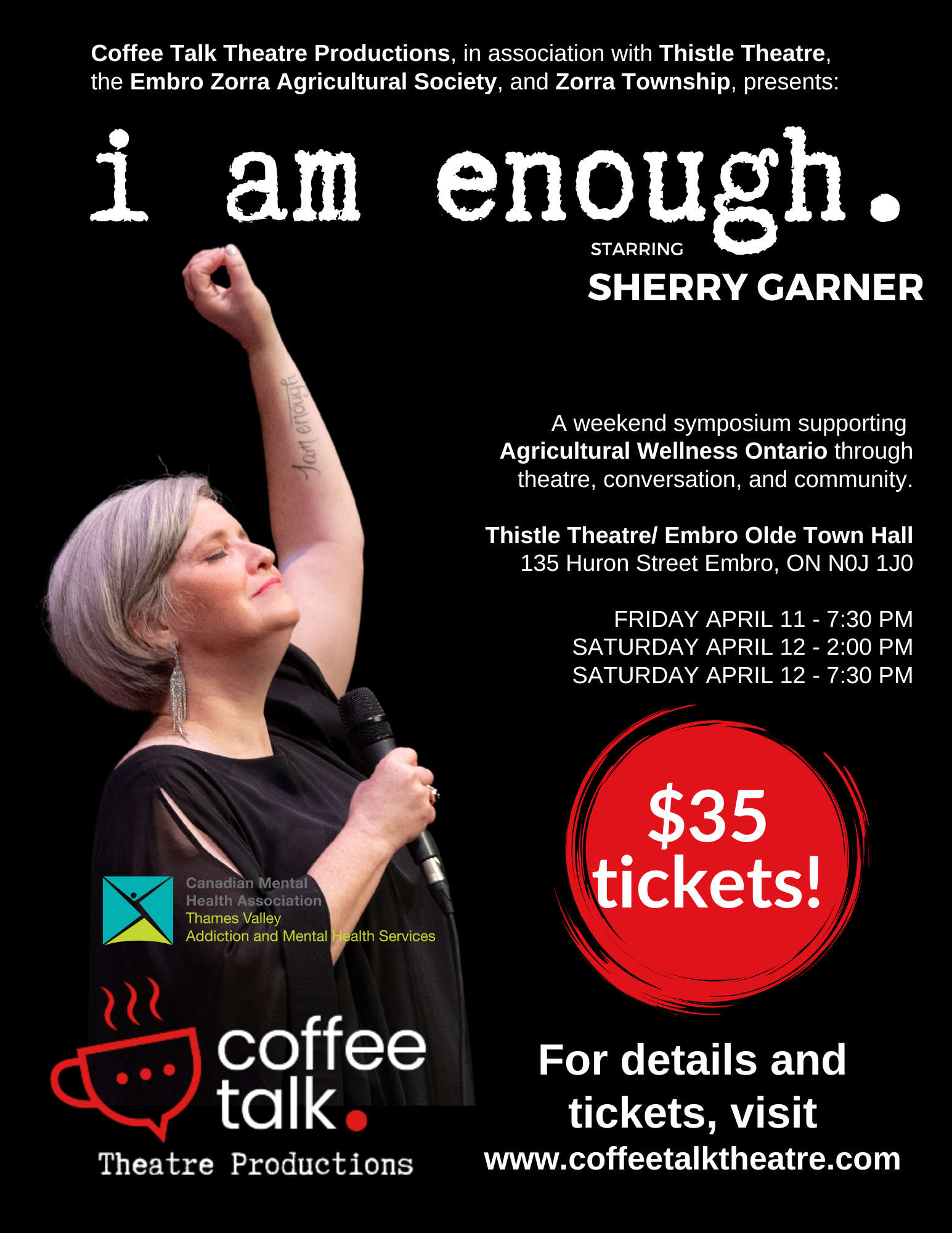

I Am Enough Comes this Weekend

I Am Enough Comes this Weekend

The OCFA has Announced their Hall of Fame Recipient

The OCFA has Announced their Hall of Fame Recipient

Strong Mayor Powers are Expanding

Strong Mayor Powers are Expanding

Markham Man Charged in South-West Oxford

Markham Man Charged in South-West Oxford

CHP Candidate Profile: Jacob Watson

CHP Candidate Profile: Jacob Watson

Trevor Birtch Trial Daily Recap - Case 1

Trevor Birtch Trial Daily Recap - Case 1